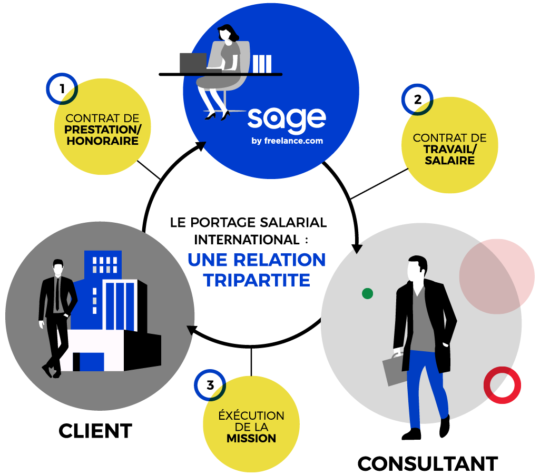

Le portage salarial international : Un partenaire essentiel pour les Managers de transition

Le monde des affaires évolue rapidement, et les entreprises sont constamment confrontées à des changements, des défis et des opportunités. Dans ce contexte, le recours à des managers de transition devient une pratique courante pour [...]

Lire l'article