The notion of umbrella company can sometimes seem obscure or even nebulous to beginners. So if we add to this the idea of “international”…

In this article, we will therefore try to make things clearer so that you can understand how it works quite simply and seize the opportunities that are open to you to develop internationally.

Self-employed status: advantages and disadvantages

You carry out your activity as an independent contractor (or Freelance consultant depending on the terms). This status has many advantages, hence its success:

- As the head of your own company, you enjoy immense freedom and have complete autonomy to organise your work.

- You choose your customers, i.e. the people you want to work with on a daily basis.

- This status allows a regular increase in income, “indexed” to your desire to work more or less intensively, depending on the opportunities and perhaps even the seasons.

- You choose your place of work, at home or outside, according to your constraints, your obligations and your comfort.

- If you say: “No hierarchy” this means fewer constraints or pressure from objectives set outside your skills set, or from your enthusiasm to carry out this or that assignment.

But there are also disadvantages to working as self-employed:

- There is an upper limit on earnings to retain autoentrepreneur (sole proprietorship) status.

- The social regime you depend on as a self-employed person is not very favourable:

- You do not benefit from paid holidays

- On the paperwork side, you have to take care of the whole administrative side alone: statements, returns, taxes, insurance, retirement, etc.

- You also have to manage invoicing and customer payments, so you need to anticipate and manage your funds well.

Umbrella company: part of the solution to the disadvantages of the Freelance status

Logically, after such an observation, we should say that the ideal would be to keep the advantages of self-employment and free oneself from its disadvantages. Although today there is no ideal status, there is a status which can nevertheless be said to be quite close, especially if you are a freelance intellectual service provider. This status is umbrella employment.

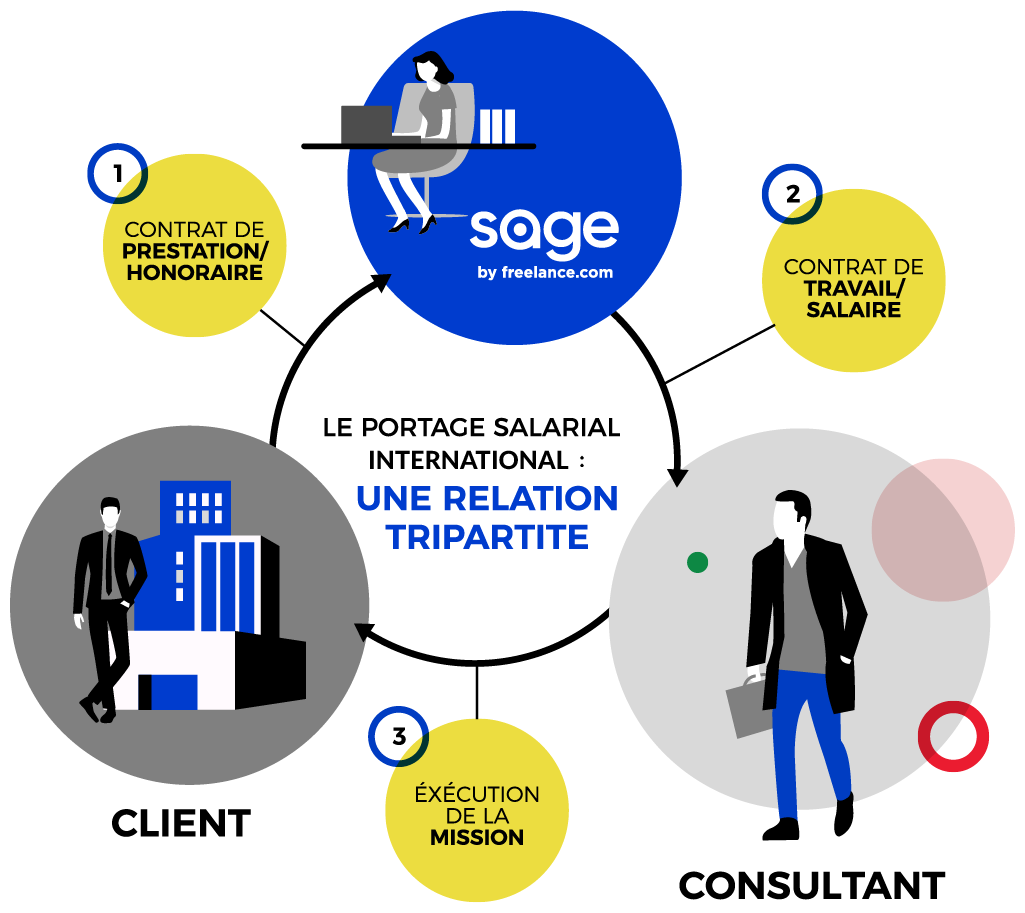

How umbrella employment works is quite simple. From a global point of view, instead of having an indeterminate number of Freelancers, each with their own company and the burden of administration that goes with it, an umbrella company takes care of all these administrative tasks, collects the turnover generated by the Freelancers, and pays them in the form of a salary, with a proper pay slip. The self-employed person retains all their advantages (freedom, autonomy, choice of assignments, etc.) while enjoying the advantages of employee (social benefits, administrative support, retirement, etc.).

If you are interested in working through an umbrella company for assignments in France, see: www.admissions.fr

And if we apply this to international assignments?

Umbrella companies, which allow a professional to perform assignments independently while retaining the advantages of salaried employment, are also suited to assignments abroad. The umbrella company works in the same way domestically or internationally.

The contractors find their assignments themselves and the umbrella company takes care of all the administrative aspects related to setting up in another country, in return for a commission on the professional’s sales. They pay the contractor a salary.

The international umbrella company concerns both short and temporary assignments carried out within the framework of a secondment, as well as long-term assignments similar to expatriation.

To learn more about international umbrella services, please go to our dedicated page