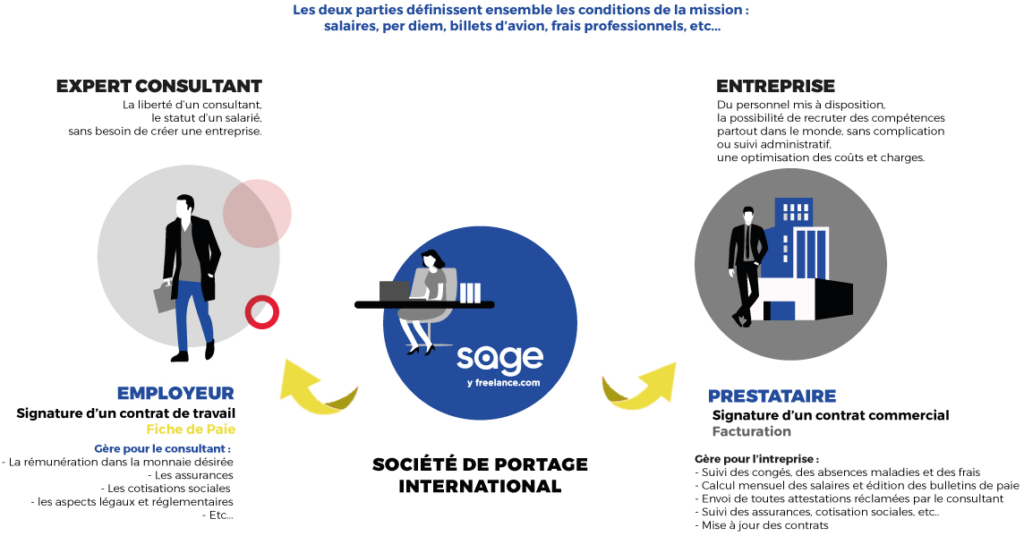

Whatever your nationality and country of destination, within the European Union as well as in the rest of the world, we provide you with special support by taking care of all the complex administrative aspects you are likely to encounter.

How it works

Specific cases

Are you a consultant or a freelancer, and you wish to offer your services to a foreign company or to carry out an assignment abroad for a French company?

- You have not been able to identify the right legal framework for working abroad?

- You think you have to create a company to be able to raise invoices for your mission?

- You are not familiar with the legislation of the country in which your assignment takes place?

- You do not have the time to manage the administrative aspects of an assignment abroad?

Your needs

- You do not have the time to manage the administrative aspects of an assignment abroad?

- You wish to secure your transaction and your assignment abroad?

- As a future expatriate executive, you would like to optimize your tax situation?

- You are embarking on an assignment abroad and are afraid of losing the benefits you enjoy in your home country?

Advantages of using an International Umbrella Company

- The freedom of a consultant and the status of employee

- No need to set up your own business, you save time, and take advantage of our network of client companies and our expertise.

- No bookkeeping, no tax inspections…

- You enjoy international employee status and the advantages that go with it: international medical coverage, accident and disability coverage and à la carte: unemployment and retirement.

Advantages of using an International Umbrella Company

- You retain control of your customers.

- Umbrella services apply in addition to employee status, if you are unemployed, a student or a pensioner still working.

- The umbrella company subscribes to a bank guarantee to ensure that your salary is paid.

Our services

IN CONTRACT:

- We manage all aspects: reimbursement of medical expenses, travel and repatriation insurance, provident funds, accident and illness, professional civil liability, unemployment, public or private pension schemes.

- A secure payroll management and communication system

- Continuous fiscal and financial optimisation

- Provision of administrative and contractual documents (employment certificate, bank comfort letter)

- Management of multi-currency expense sheets

- Offers the Swiss legal framework, including in terms of labour and tax legislation

- Operational assistance and consultancy including in the domains of the law and fiduciary affairs.

- A dedicated administration contact person for personalised support services

- Filing of returns and payments of social security contributions in the country of origin

- The payment of withholding tax, if necessary in the host country

OPTIONAL:

Work permit applications

Organisation of travel and relocation in the host country

Management of immigration requirements

Subscription to an international pension scheme